Navigating green economy and development objectives: African energy transition opportunities and risks

African countries and economies are at the centre of competing demands and narratives around the global green transition. Bruce Byiers, Alfonso Medinilla and Karim Karaki identify the dilemmas they face in achieving ‘greener’ economic development pathways. In this third note out of a series of four, they zoom in on African energy transition opportunities and risks.

Summary

African countries and economies find themselves at the centre of competing demands and narratives around the global green transition. The continent is rich in renewable energy sources and the minerals needed to power a global shift to clean energy while reducing, or avoiding greenhouse gas emissions is also seen by many as a risk to African economic development and akin to rich countries ‘kicking away the ladder’.

This note is part of a series of four notes and a synthesis paper, which identify and discuss the dilemmas faced by African countries in achieving ‘greener’ economic development pathways. This third note focuses on the opportunities and risks for African countries linked to the energy transition and green industrial development.

The accompanying notes look at ways to navigate the conflicting narratives on an African ‘just (energy) transition’ and the challenge of economic development; the increasingly complex effects of external climate regimes on African economies; and the political economy dynamics and complexity of green transition in practice, taking the case of transport in East Africa. The synthesis paper combines all four notes and identifies overarching recommendations and policy opportunities.

Introduction

African countries and economies find themselves at the centre of competing demands and narratives around the global green transition. The continent is rich in renewable energy sources and the minerals needed to power a global shift to clean energy, with several countries positioning themselves to take advantage of new opportunities and attract investment. At the same time, reducing, or avoiding greenhouse gas (GHG) emissions is also considered by many to be a risk for African economic development. As late industrialisers, African countries contribute less than 4% of global GHG emissions, and are now faced with increasing pressure to forgo a fossil fuel-driven industrialisation pathway. Some see this as rich countries ‘kicking away the ladder’ that they themselves used to develop, denying the continent a chance to leverage its own resources to catch up to the industrialised parts of the world (1).

This note – part of a series of four notes and a synthesis paper (2) – discusses the opportunities and risks for African countries linked to the energy transition and green industrial development.

The accompanying notes look at:

- the conflicting narratives on an African ‘just (energy) transition’, and the challenge of economic development in a carbon-constrained environment;

- the increasingly complex effects of external climate regimes on African economies; and

- the political economy dynamics and complexity of green transition in practice.

The following emerge as key takeaways from the four notes:

|

The remainder of this note discusses the factors that enable countries to navigate international climate regimes, to manage trade-offs, and to benefit from new opportunities both within and between countries.

Africa’s first movers: geographical, industrial and commercial enablers of a green transition

Though many countries are struggling to adapt to climate shocks and to affect a ‘green transition’, several African countries are positioning themselves as first movers in a global green transition. Especially in the field of renewable energy, some African countries are able to leverage their renewable energy potential, international finance and existing industries to scale up their renewable energy capacity. Kenya and Morocco, for example, both have a solar and wind power share of more than 10% of total power generation, putting them well ahead of the US, China, and several European countries in intermittent renewable energy capacity. Both countries are progressive in international climate diplomacy, and actively market their economies as prime destinations for future green industries and sustainable investment. This note looks beyond the headline figures, at what enables these countries to use ‘greening’ as an opportunity. In particular we highlight the importance of structural factors such as renewable energy potential, as well as existing industries and sectors that can directly benefit from the green energy transition, and discuss future opportunities and risks linked to green hydrogen production for African countries.

Structural factors: Kenya’s historical renewable energy capacity

Kenya is often seen as a clean energy champion on the African continent. In 2021, clean energy sources accounted for 80% of Kenyan electricity generation. The government intends to increase this share to 100% by 2030. Kenya benefits from various sources of clean energy, not least hydropower and significant geothermal energy sources. These provide a stable base on which it can expand intermittent renewables like solar and wind power. Kenya also gets power from its neighbours through a power purchase agreement with Ethiopia, and is developing a gas pipeline with Tanzania. Kenya’s own fossil fuel resources, in contrast, are limited, meaning that it relies on expensive imported oil and gas for its needs. Kenya’s early development of geothermal energy in particular, with its first plant commissioned in 1981, has given Kenya a significant lead in clean energy in Africa. This has also helped the country initiate several power sector reforms since the 1990s, making it a preferred African destination for private energy investment.

These structural and sectoral factors have allowed Kenya to prioritise both large-scale and smaller scale wind and solar power to further expand installed capacity, with lower risks and costs than other African countries. This also translates into ambitious targets for further deploying renewable energy (3) and a more optimistic outlook on the green transition and the opportunities it can bring for green manufacturing and climate-smart agriculture. At COP27 Kenya’s president explicitly called on developed economies to “[redirect] industrial investments to Africa and [make] use of clean energy to manufacture for the world”. The country used COP27 to fasttrack commitments for new green energy projects, including for the production of green ammonia with Australian Hydrogen developer FFI.

Industrial competitiveness: decarbonising Moroccan fertilisers

Morocco’s energy transition pathway is closely intertwined with its existing industrial and extractive base. Morocco still relies heavily on imported fossil fuels, including coal for its energy production, but has recently emerged as a leader on renewable energy, attracting significant investment in solar and wind power, and is on a path to develop significant renewable energy capacity to decarbonise its phosphate mining and fertiliser industry in the coming decades (4). Morocco has around 70% of the world’s reserves of phosphate rock, an essential component of phosphatic synthetic fertilisers. While it has long been a key exporter through its state-owned mining group OCP, the country has become one of the top-five exporters of finished fertilisers, and intends to maintain and further expand its supply to both African and global markets (5).

Morocco currently relies on imported ammonia to produce its fertilisers, traditionally produced from natural gas. In 2021, the costs of producing ammonia reportedly increased nearly tenfold compared to the previous year, putting significant pressure on the industry worldwide. As locally produced ammonia from ‘green hydrogen’ offers the possibility to replace those imports, Morocco was the first country to sign a hydrogen production agreement with Germany in 2020. More recently, OCP announced a USD 12.3 billion investments in green energy and desalination (6) to decarbonise its fertiliser production by 2027. Morocco is also well placed to become an export hub for green energy through interconnections with Europe via Spain, and green hydrogen (7), giving it the prospect of both internal and external demand for hydrogen.

The combination of natural resource endowments, renewable energy potential and a strong industrial base has allowed the country to make a decisive shift to green energy, not only to modernise its energy system, but to ensure the long-term competitiveness of its fertiliser industries. Early investments in green hydrogen, but also renewable energy for electricity exports can help Morocco cement its long-term access to the EU market. Electricity and fertilisers are both covered by the CBAM, which may help future Moroccan green exports, especially since the EU fertiliser market has been heavily affected by the Russian invasion of Ukraine (8).

African hydrogen exports: balancing risks and opportunities

Interest in and commitments to African green hydrogen and ammonia development surged around COP27, as they did around COP26 in Glasgow in 2021. The EU has long been at the forefront of the hydrogen debate. As an energy-poor continent, it is betting heavily on hydrogen to power its industrial transition, including for hard-to-abate sectors like iron and steel, chemical industries and shipping. Europe’s energy crisis since the war in Ukraine has also led the EU to frontload plans for using green hydrogen and ammonia to transition hard to abate industrial sectors and the shipping sector, including plans to import 10 million tonnes of renewable hydrogen by 2030.

Several African countries are working to develop hydrogen exports, and are actively pursuing deals and commitments, both in partnership with Germany, Europe’s largest industrial centre (9), and with a range of global energy companies. As well as Morocco, two countries that stand out are Namibia and Egypt10. Namibia is working with Germany to become the continent’s first green hydrogen hub, supplying domestic, regional and international markets and has plans to deliver 350,000 tones of green hydrogen by 2030. Egypt has been very successful in collecting green hydrogen commitments ahead of COP27, and is particularly betting on green ammonia to supply the shipping industry. The country also entered into a strategic partnership with the EU on renewable hydrogen to facilitate investment and future trade (EU and government of Egypt 2022).

Renewable ammonia, produced from green hydrogen similarly presents opportunities for some African economies, especially given the high prices of natural gas since 2022, which has historically been the source of ammonia production (11). Today, around 85% of ammonia worldwide is used to produce nitrogen fertiliser, yet green ammonia is also set to be used as an alternative maritime shipping fuel, and long-range carrier for hydrogen. While some safety issues still need to be addressed, major carriers, including Denmark’s MAERSK are investing heavily in e-fuels (including green methanol) and preparing the ground for ammonia use. The company is developing a range of projects to prepare green fuel production in Europe and abroad. In 2022 it signed memorandums of understanding (MoU’s) with Oman and Egypt among others, to explore large-scale green fuel production and bunkering to supply shipping lanes. Egypt in particular has positioned itself to develop the Suez Canal special economic zone (SCZONE) as a future green fuels hub, and has reportedly signed over 20 MoUs to date, aiming at operational activities in e-methanol, green hydrogen and ammonia within the decade.

While these initiatives illustrate the central role African countries could play in a global industrial energy transition, the hydrogen economy and related trade flows are still at a very early stage of development. Key issues for (prospective) African producers include:

- EU industrial demand is still fairly low: While hydrogen will be key to decarbonise Europe’s hard-to-abate sector, market demand remains limited today, and future volumes are hard to predict. European countries have increasingly moved away from hydrogen for road transport, which shows that a correction of expectations of the scope of Europe’s hydrogen economy and import demand may still follow.

- African industrial demand is limited and highly concentrated: Morocco (see above) in particular has the basis for a strong industrial demand. Other countries, including Egypt, South Africa and Kenya, have or are developing hydrogen strategies, yet current demand from African industries is limited.

- Low deployment of renewable energy for green hydrogen: Production of green hydrogen requires sufficient supply of renewable energy. This is currently not the case in Africa given the relatively low levels of deployment. Only about 9% of overall energy generated in Africa comes from renewable sources.

- Transport and storage costs significantly affect the price of renewable hydrogen: Optimistic scenarios see the price for producing green hydrogen drop to under USD 1/kg in all regions of the world by 2050. Transport costs, however, will be a significant portion of the final price. EU imports from North Africa and the Middle East have the greatest theoretical potential to compete on price, depending on pipeline infrastructure and a range of other factors.

- Africa’s low-carbon industrial potential is severely underutilised: IRENA estimates that the bulk of green hydrogen and ammonia in 2050 will be regionally traded, rather than globally. African countries have the theoretical potential to be highly competitive in both direct electrified industries and hydrogen consumption. North Africa and the Middle East for example have a significant theoretical potential for green steel production using hydrogen-based Direct Reduced Iron (12), yet North Africa today only houses a fraction of global production, while investment in steel decarbonisation tends to focus on existing production centres in Asia, Europe and the US.

While African green hydrogen may offer an opportunity for African economies, it will also entail significant risks, especially for those countries that are primarily focusing on the future export market for hydrogen and derived commodities, including ammonia (13). In the absence of stable export demand and established trade flows and hydrogen infrastructure, African economies may need to readjust their expectations and focus on attracting and developing African low-carbon industries.

In the absence of stable export demand and established trade flows and hydrogen infrastructure, African economies may need to readjust their expectations and focus on attracting and developing African low-carbon industries.

Box 1: How climate finance can unlock green energy opportunities including for low-carbon industrial development

|

Rising inflation driven by energy and food prices, coupled with a stronger dollar is threatening the debt sustainability of African countries which already spend 3% to 9% of their GDP on measures to address climate risks and disasters. Many countries therefore have limited financial capacities to green their economies. In this context, development finance that mobilises additional private investments is seen as a means to reconcile different objectives, i.e. foster socio-economic development while contributing to climate actions. Financing is now more readily available for green energy projects, as governments, donors and financial institutions prioritise projects that can help meet their sustainability goals.

MDBs/DFIs can also provide financing in local currency, or provide financial instruments hedging the currency fluctuations for the project promoters. This is increasingly important in a context where the value of the dollar is expected to keep rising, following the US Federal Reserve decision to increase interest rates. |

Policy implications

The experience of Africa’s ‘first movers’ shows that Africa’s clean energy potential is only one factor among many that define a country’s ability to secure benefits in a global green transition. Kenya and Morocco’s experiences are driven by short-to-medium term economic and social objectives and not only longer-term climate concerns. Kenya and Morocco both have structural, geographical factors that enable them to pursue an clean energy trajectory that combine with commercial incentives to green their economies and position themselves for future opportunities. This has enabled their governments and policy-makers to also take ambitious positions in climate negotiations, which in turn (will) facilitate their strategic access to international climate finance. This means that for these countries, the economic gains they can derive from green energy investments outweigh the potential risks and costs associated with a first mover status. But these are not in place in all African economies, many of which are constrained by underperforming energy systems, or tied to fossil fuel industries that threaten their ability to position themselves on the winning side of a global energy transition.

A closer look at the developments around renewable hydrogen illustrates how some African countries might position themselves at the centre of an interconnected green economy with Europe. Yet it also shows that in order to effectively leverage Africa’s geographical advantages, countries must focus on developing local industrial applications, hydrogen consumption and regional markets in addition to exports.

Doing so requires a level of access to finance that is difficult to attain for many African countries, many of which are already facing debt distress. International climate finance may play a role in offsetting some of the challenges of securing energy investment and promoting green industrialisation, yet this requires a different approach to risk management, especially in fossil-fuel dependent economies, where the disincentives will be both structural and deeply ingrained. Technical assistance and policy support will be crucial to better connect demand and supply and a steady flow of bankable projects.

Paper and other notes

This is the first note out of a series of four. In our paper, we combine the four notes and share overarching recommendations and policy opportunities. You can find the paper and the other notes here:

References

Agora. 2022. Global Steel Transformation Tracker.

Basirat, S. 2022. Green steel opportunity in the Middle East and North Africa, IEEFA, 14 September.

Chang, J-H. 2003. Kicking Away the Ladder: Development Strategy in Historical Perspective, Book.

Climate Champions. 2022. African Green Hydrogen Alliance launches with eyes on becoming a clean energy leader, News, 18 May.

ControlRisks. 2022. Can Africa clean up with green hydrogen? Analysis, 26 May.

Čučuk, A. 2022. Plans to turn SCZONE into green fuel hub gain momentum, Offshore Energy, 9 December.

EU and government of Egypt. 2022. Memorandum of understanding on a strategic partnership on renewable hydrogen between the European union and the Arab republic of Egypt, 16 November.

Garowe. 2023. Kenya purchases cheap electricity from Ethiopia to meet local power demand, 5 March 2023.

Green Hydrogen Organisation. 2022. Development finance for the green hydrogen economy. Priority actions for development finance institutions.

IRENA. 2022. Global hydrogen trade to meet the 1.5°C climate goal: Part I – Trade outlook for 2050 and way forward, International Renewable Energy Agency, Abu Dhabi.

IRENA and AEA. 2022. Innovation Outlook: Renewable Ammonia, International Renewable Energy Agency, Abu Dhabi, Ammonia Energy Association, Brooklyn.

Kenya National Bureau of Statistics. 2022. Energy-Electrical Power Systems, Kenya - Country Commercial Guide.

Kobina Kane, M. and Gil, S. 2022. Green Hydrogen: A key investment for the energy transition, World Bank blogs.

MAERSK. 2022. Maersk explores new ways to accelerate green fuel production, press release, 8 March.

Nweke-Eze, C. and Quitzow,R. 2022. The promise of African clean hydrogen exports: Potentials and pitfalls, Brookings, 10 May.

O'Farrell, S. 2022. Kenya’s FFI green hydrogen deal: ‘Other countries will follow suit’, interview, FDI Intelligence.

Ovcina Mandra, J. 2022a. Maersk to study feasibility of green fuels bunkering in Oman, Offshore energy, 6 December.

Ovcina Mandra, J. 2022b. Egypt ramping up efforts to make SCZONE clean fuel production hub, Offshore energy, 15 November.

Ruto, W. 2022b. Doing development differently: How Kenya is rapidly emerging as Africa’s renewable energy superpower, Rapid Transition Alliance, 17 November.

Tanchum, M. 2022. Morocco’s New Challenges as a Gatekeeper of the World’s Food Supply: The Geopolitics, Economics, and Sustainability of OCP’s Global Fertilizer Exports, MEI@75, 18 January.

UNECA 2022a. Communiqué Egypt – International Cooperation Forum and Meeting of African Ministers of Finance, Economy and Environment, 7-9 September 2022, Al Masa Convention Center New Administrative Capital, Cairo, Egypt.

Walsh, G., Ahmed, I., Said, J., E Maya, M. F. 2021. A Just Transition for Africa: Championing a Fair and Prosperous Pathway to Net Zero, Tony Blair Institute for Global Change, October 2021.

WEF. 2022. This is the state of renewable energy in Africa right now, World Economic Forum, 11 April.

Endnotes

1. The original idea of ‘kicking away the ladder’ comes from Ha-Joon Chang’s discussion of how developed economies used trade protectionism to develop, before promoting trade liberalisation (Chang 2003).

2. This paper is based on a desk review carried out in the second half of 2022, as well as a series of interviews with Kenyan stakeholders and experts carried out in November 2022.

3. Kenya’s most current draft Energy Sector Roadmap outlines a highly ambitious strategy to scale up energy production and take advantage of the shift to a clean economy around the world, with a goal of 100 GW of installed capacity by 2040 (Kenya Ministry of Energy 2022).

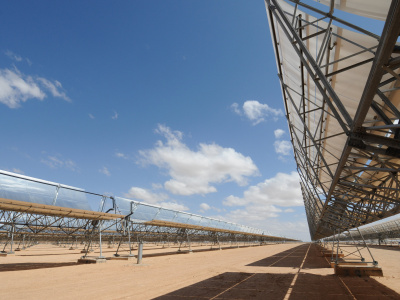

4. Morocco is well known for its large scale concentrated solar power plants, the Noor Ouarzazate Solar Power Station (a 580 MW facility), but also has considerable wind power capacity, e.g. the 301 MW Tarfaya wind farm.

5. The OCP Group (formerly Office Chérifien des Phosphates) accounts for ca. 20% of Morocco’s export revenue (Tanchum 2022).

6. Hydrogen electrolysis with green energy requires significant freshwater resources that are in short supply in North Africa.

7. IRENA estimates that the country, due to its geographical proximity to the EU market and renewable energy capacity, has the potential to become a highly competitive source of green hydrogen in the future (IRENA and AEA 2022).

8. Before the EU imposed trade sanctions, 60% of its fertiliser imports came from Russia and Belarus, while the EU’s own production relies on imported natural gas (Fox and Vasques 2022).

9. Germany houses 27% of the EU’s industrial production and has been proactively seeking hydrogen partnerships with a range of African countries, including Namibia, DRC, Angola and Nigeria since 2020 (Nweke-Eze and Quitzow 2022).

10. Together with South Africa, Mauritania and Morocco, these countries are part of the African Green Hydrogen alliance, which is meant to position the continent as a frontrunner (Climate Champions 2022). Several others, including Kenya are also pursuing hydrogen investments.

11. Worldwide, around 183 Mt of ammonia is produced annually, the bulk of which comes from natural gas (72%) or coal (22%). Renewable or green ammonia is made from renewable hydrogen, using nitrogen that is separated from air (IRENA and AEA 2022). Less than 0,2 Mt of renewable ammonia was produced in 2021, yet IRENA and AEA (2022) estimate the capacity of announced plants (worldwide) will be around 15 Mt by 2030, with a further 71 Mt in the pipeline. New capacity in the second half of the decade and the 2030s will likely be dominated by renewable production. Its projections further estimate that in a 1.5C scenario the green ammonia market could grow to 688 Mt per year, or more than a 400% increase in ammonia production (IRENA and AEA 2022).

12. While the bulk of global steel production uses coal-based blast furnaces, natural gas fired direct-reduced iron (DRI) is used in the Middle East and North Africa today. The move to hydrogen-based DRI (Agora 2022).

13. There is also a risk that the prospect of future export markets incentivises governments to choose an ‘extractive model’ of green hydrogen production, which prioritises exports over local energy consumption and industry transition. This risk is particularly high in economies that already heavily rely on the export of raw materials, such as Namibia, Angola, and Nigeria.