Green hydrogen: The future of African industrialisation?

Authors

As the world crosses peak hydrogen hype, can the hydrogen economy be a game-changer for African industrialisation or is it extractivism under a green veil? Alfonso Medinilla and Koen Dekeyser examine the latest developments in green hydrogen for exports and industrial use, and explore the role African economies can play in the global hydrogen economy.

Summary

As the world crosses peak hydrogen hype, how can African countries maximise the industrial and economic development opportunities while minimising the risks? Can the hydrogen economy be a game-changer for African industrialisation and job creation, or is it extractivism under a green veil?

We examine the latest developments in green hydrogen for exports and industrial use and explore the role African economies can play in the global hydrogen economy.

Green hydrogen and its derivatives, like green ammonia, can be used as a feedstock for low-carbon industries, a (zero-carbon) fuel for shipping and aviation, and an energy carrier to be re-converted to electricity.

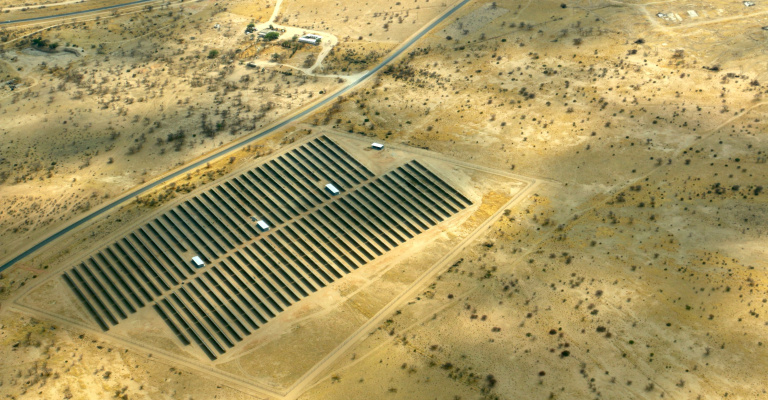

Green hydrogen is also seen as a way for African countries to leapfrog outdated technologies and leverage their massive solar and wind power potential. Many countries are looking to become major exporters of hydrogen, ammonia and other derivatives while simultaneously developing a domestic hydrogen economy to jumpstart their long-overdue industrialisation.

Yet the hydrogen economy also raises many questions about how countries can best position themselves for near-term investments and long-term opportunities. Maximising the benefits of African green hydrogen will require action on multiple fronts, including industrial policies, energy systems, international partnerships, regional cooperation and domestic markets. This is more than a technical matter or a question of demand and supply. It calls for an in-depth understanding of the political economy of industrialisation in developing countries and how they can position themselves in new and emerging global value chains.

Hydrogen supply and industrial demand

The world consumed 95 million tonnes of hydrogen in 2022, the majority of which goes into traditional chemical industries and oil refining. While green hydrogen and so-called renewable fuels of non-biological origin (RFNBOs) are meant to play a significant role in decarbonisation, only 0.1% of 2022 hydrogen demand came from new applications providing an alternative to fossils and their derivatives: as a feedstock in the chemical industry as a reducing agent for steel production, or as a fuel for industrial heat. Low-carbon hydrogen produced with electrolysis using green electricity today is less than 1% of total demand, and more than 80% of hydrogen today is made directly from natural gas and coal.

Global hydrogen demand projections linked to industry decarbonisation vary widely, though most foresee a modest increase in use between now and 2030, with exponential growth to up to 400 Mt, or even 600 Mt per year by 2050. Unlike other major cornerstones of decarbonisation, like renewable energy deployment or electric vehicles, the hydrogen economy remains in a relatively early and in some cases experimental stage. This means that while major long-term opportunities are expected, the path to get there is far less clear.

Policy targets and subsidies are the driving force...

With the production of green hydrogen in its infancy, price parity with fossil fuel-derived hydrogen is still quite far off. In 2023, the cost of producing green hydrogen through electrolysis was on average three times that of grey hydrogen from natural gas (see Figure 1).

While analysts are confident that price parity is within reach by 2030, policy targets and subsidies are driving most of the interest and early investments and commitments to green hydrogen production. Early off-takes will be concentrated in compliance markets such as the EU, where industries are subject to tightening emissions restrictions.

The European Commission in particular has launched ambitious targets for producing 10Mt domestically and importing a further 10Mt of hydrogen by 2030. In 2023, the EU also launched the first €800 million auction for (EU-produced) renewable hydrogen under the EU Hydrogen Bank using EU emissions trading revenues. The US, however, accounts for the bulk of global subsidies going to hydrogen production –more than 50% of the ca. $280 billion – that was announced in 2023 worldwide– and uses this for promoting US-produced hydrogen.

European incentives, while more modest than those of the USA, also target non-domestic production. This may create opportunities for African countries. The EU’s domestic hydrogen auction will be followed by an international one. Member states, especially Germany, but also the Netherlands, Belgium and Italy, have been actively setting up new hydrogen partnerships with future suppliers in various parts of the world to develop infrastructure and supply routes through pipelines and sea freight for hydrogen and derivatives. Germany also set up its own ‘double auction’ procurement system, H2Global, offering long-term off-take contracts with producers and competitive sales to consumers, with the German government compensating for the difference between the two.

...yet demand projections are uncertain and inflated

While these policies and subsidies are meant to generate an affordable supply and bridge the price gap between green and fossil fuel-derived hydrogen, reliable demand projections can be difficult to make. This is partly because setting up a new industry from scratch not only requires significant upfront investments, it can bring additional uncertainty, especially since hydrogen use cases are still taking shape.

Europe initially had a maximalist outlook on hydrogen demand, with policy-makers and lobbyists calling for widespread use of the molecule in industries, transport and buildings. 2030 Hydrogen targets were also dramatically increased in 2022, following the Russian invasion of Ukraine, going from 5.4 Mt to 20 Mt to power an accelerated phaseout of fossil gas dependencies. This is supported by a large and concerted lobbying effort including by fossil fuel companies who see hydrogen as a continuation of their existing business model, namely a resource that can be stored, shipped and transported through pipelines. While Europe is going big on hydrogen, going too big, especially with the constraints of public resources can create significant risks in the long run.

|

BOX 1: “No-regret” hydrogen |

Hydrogen and derivatives will play a crucial role in decarbonising industries, air travel and shipping, but today, analysts generally see a much smaller role for hydrogen in transport and even a negligible one in residential heating. Leading German energy think tank Agora Energiewende in 2023 estimated that in a more efficient scenario, eventual European hydrogen demand in 2030 could be less than a fifth of the RePowerEU projection.

For prospective exporters, this means that while guaranteed off-takes through subsidised schemes like the EU Hydrogen Bank or H2global could create opportunities and commercial activity in the short run, long-term export markets are all but assured.

Notes: Artelys, TEP Energy, Wuppertal Institute modelling (2023). Commission sta working document accompanying the REPowerEU plan (2022). *Derivatives include ammonia and synthetic fuels. Ammonia has a lower calorific value than H₂. The REPowerEU plan seems to have used the same conversion rate for ammonia as for H₂ for its calculations in Mt. Assuming all of the 20 Mt hydrogen and derivatives in the REPowerEU plan are renewable.

Transport and conversion costs can double the price

Compared to fossil fuels, the location of green hydrogen production and transport infrastructure for hydrogen and its derivatives will have a far greater impact on the price, than is the case with natural gas.

Short to medium-term investments are driven by partnerships, projected demand and subsidies, however, in a more market-driven scenario, some exporters will be much better placed than others.

There are significant technical constraints to hydrogen trade with Europe. Early plans for global hydrogen trade flows focused on where green hydrogen can be produced at the lowest cost per kg, while insufficiently taking account of the processing and transport costs. Hydrogen can be transported through pipelines, liquified, and transformed into various carriers, much like natural gas, but the costs of transporting hydrogen over long distances will be a much greater proportion of the final price. The geographical location of hydrogen production therefore may have a much bigger impact on the final price than previously assumed.

Recent IEA estimates show that in the case of hydrogen, pipeline delivery from North Africa, and in the case of ammonia for direct use, shipping from both North Africa and Latin America can compete with domestic production. (see Figure 3) Liquefied hydrogen or reconversion of carriers are necessary for importing hydrogen from many other parts of the world but can more than double the final cost per kg, making it commercially less attractive in the long term.

Natural gas business models are difficult to apply

Proximity to consumption is key. This also means that the basic commercial concepts of natural gas cannot be easily applied. Yet hydrogen continues to be seen through the lens of the business of natural gas, namely energy in the form of a tradable molecule.

One way countries have been dealing with low current demand is to develop natural gas and LNG infrastructure, which in due course could be transitioned to green hydrogen and RFNBOs once the market for green molecules is more mature. This was the logic behind Germany’s investment in LNG terminals on the North Sea coast. While the ‘hydrogen readiness’ of major projects creates a longer-term perspective and helps to secure finance and public support, analysts also warn that converting LNG and natural gas infrastructure to hydrogen or ammonia, even if considered from the start, will require substantial adaptations, and therefore costs, which may only be recoverable in a maximalist scenario of European hydrogen demand.

IRENA estimates that in 2050 roughly a quarter of worldwide hydrogen consumption could be supplied through international trade. Based on a pure cost-optimisation model, 55% of that amount would need to be traded via pipelines, with 45% shipped, primarily in the form of ammonia. Given the high storage and conversion costs, Liquefied hydrogen (LH2) is likely to play a negligible role.

Domestic production in major industrial centres will therefore likely play a much bigger role, even with imported electricity, which in some cases may be a more affordable option. With such transport challenges, countries that can, in theory, produce some of the lowest-cost hydrogen, may be unable to secure long-term off-takers, especially for hydrogen, in an open market.

While a host of other political and economic factors will eventually define how international hydrogen trade will take shape, some of the structural, and geographic factors will be very difficult to overcome. Most projections locate the bulk of African export potential in North Africa, where pipelines to Europe are cost-effective, and several plans are underway. (see Figure 3) There may be more ammonia export opportunities than for hydrogen as transport costs are lower. This may include South Africa and even Namibia, which has been a first mover in the hydrogen space, in partnership with Germany.

From exports to industrialisation

While exports present opportunities to some African countries, the risks can also be considerable, given the chicken-and-egg situation between low-cost production of green hydrogen and large-scale consumption in decarbonised industries.

Exports, however, are only part of the picture.

Many African countries are developing highly ambitious hydrogen economy strategies (figure map). The underlying assumption is that cheap hydrogen can be a game changer for their economies, and can ‘flip the script’ from energy poverty to green energy leadership. At the same time, initiatives like the Africa Green Hydrogen Alliance, between Egypt, Kenya, Mauritania, Morocco, Namibia and South Africa, and several national strategies have an implied sequencing between export markets and domestic hydrogen economies: Exports of hydrogen, ammonia, and other derivatives like e-fuels create “breakthrough opportunities” to develop the sector today, while unlocking domestic opportunities for decarbonised heavy industries tomorrow.

This is partly because the cost competitiveness of green hydrogen is yet to be reached. As industrial use of hydrogen and derivatives still needs to be built up in the 2020s, production as well as consumption is likely to heavily rely on price subsidies (carrot), and pressure from carbon pricing and regulatory initiatives (stick). Yet all these are currently concentrated in major industrial centres in Europe, the US, and China.

Critics argue that this overemphasis on exports can lead to a ‘neocolonial resource grab’, and that prioritising renewables for the export of hydrogen and derivatives, without clear additionality, recreates existing extractivist dynamics between Africa and Europe, adding little value locally.

At the same time, however, there is a strong technical case to seek early investments in green hydrogen and other energy-intensive industries in African countries. In essence, African countries could position themselves for a ‘renewables pull’, a scenario in which energy-intensive industries increasingly move to where electricity, or indeed hydrogen can be produced at the lowest possible costs.

Several studies, for example, have shown that the MENA region is ideally placed to produce green iron and steel, not only because it has among the lowest cost projections, but also because it already has an established direct reduced iron steel industry, and proximity to key markets for green steel, including the European Union. It may therefore make more sense to prioritise the export of low-carbon steel over green hydrogen.

Several countries are also preparing the ground for domestic hydrogen economies. South Africa’s 2022 green hydrogen strategy for example puts a strong emphasis on the development of a domestic market for hydrogen mobility and shaping a green hydrogen hub around its steel and chemical industries. Kenya seeks to prioritise ‘no-regret’ options built around import substitution for methanol and nitrogen fertilisers. Morocco, in turn, has a maximalist hydrogen roadmap, covering both transport (including e-fuels) and industries (fertilisers, industrial heat, refining), all while seeking to capture up to 4% of global export market demand for hydrogen by 2030.

One application, green ammonia for nitrogen fertilisers, stands out across the continent, as it has the potential to substitute expensive and carbon-intensive imports, but also to tap into potentially significant domestic and regional growth markets for fertilisers.

Green nitrogen fertilisers, a specific African opportunity?

Around 60% of the industrially produced (“grey”) hydrogen worldwide is used to make ammonia (NH3), 70% of which in turn is used to produce nitrogen fertilisers. This makes ammonia production the largest carbon-emitting chemical industry process by far, contributing to 1.4% of all greenhouse gas emissions. Nitrogen accounts for more than half of the total weight of the major fertiliser nutrients (others being phosphorus and potassium).

Its reliance on natural gas makes the nitrogen industry not only very carbon intensive but also subject to high price volatility. The Russian invasion of Ukraine in 2022 in particular caused a significant price spike in global fertiliser prices, as Russia was not only a major supplier of natural gas to Europe’s fertiliser industry but, together with Belarus, also a major fertiliser exporter.

Green ammonia uses renewably produced hydrogen and cuts out natural gas entirely. While nitrogen fertilisers will still emit potent greenhouse gases after field application, green ammonia can dramatically lower emissions from nitrogen fertiliser production and shield producers from fossil fuel price volatility.

African countries could potentially hit two birds with one stone: use their unique renewable energy potential to produce low-carbon fertilisers and tap into a potential growth market for hydrogen exports.

Multiple African countries are exploring green ammonia production for fertilisers, both for exports and domestic markets. Part of the reasoning is that most African agricultural systems severely underapply fertilisers and also import most of those that they do use. This could then make for a potentially significant growth market for (green) African fertilisers.

Source: FAO

Current and prospective producers, however, have very different starting points and industrial capabilities that can make or break a domestic green hydrogen economy. Much like exports, while opportunities exist, they may be more unevenly distributed than is often assumed.

Morocco is Africa’s biggest fertiliser producer and exporter. It has around 70% of global phosphate rock reserves – one of the three major fertiliser nutrients – and is the world’s fifth largest fertiliser producer with the state-owned OCP group as a global lead firm, supplying markets in, among others, South- and North America, India, Europe, Nigeria, and other parts of Africa. OCP however, needs to import around 1.8 million tons of ammonia per year, previously relying heavily on Russia and Ukraine, in order to supply nitrogen-enriched compound fertilisers. In 2022, OCP announced a $13 billion renewable energy investment plan, which includes a $7 billion investment in a green ammonia plant in the country’s South, set to start production in 2026. The company is developing this as a captive system with dedicated solar and wind power for the production facilities.

Egypt is Africa’s second-largest fertiliser producer, exporting just under one-third of Morocco’s volume in 2022, focusing strongly on nitrogen fertilisers like urea. Its largely state-owned industry produces 22.5 million tonnes of fertilisers annually, of which around 10 million tonnes is used domestically and supported by a generous input subsidy programme, which may lead to inefficient overapplication. Egypt produces around 6 million tonnes of grey ammonia annually by using its own natural gas. Like Morocco, Egypt is positioning itself to be a major hub in both green and blue hydrogen and derivatives like ammonia, hoping to capture 5 to 8% of the global market for these molecules. Much attention is going to hydrogen and ammonia production for shipping in the Suez Canal. The fertiliser industry itself has also announced significant investments, including a $1.2 billion green ammonia facility.

Africa’s major fertiliser producers are making moves to decarbonise their industries. Morocco, in part to hedge against price volatility, and anticipating a growing export market for green fertilisers; and Egypt, as part of its hydrogen economy ambitions, while riding the spike in exports and fertiliser profits since 2022. Both, however, can rely on distinct but significant industrial capabilities, as well as established domestic and export markets.

Source: UN COMTRADE

Source: FAO

Other countries looking to enter into the green nitrogen fertiliser game will need to build up these industries from a much lower base. Kenya, for example, has been actively positioning itself to attract investments in energy-intensive industries, leveraging its 90% share of renewable energy to attract clean industry investments. It is an ambitious newcomer in the green hydrogen space. One of its ‘no-regret’ aspirations is to use hydrogen to substitute up to 50% (or 300,000 tons) of its growing imports of (partly subsidised) nitrogen fertilisers with locally produced green fertilisers by 2032. Like most of Sub-Saharan Africa, Kenya is nearly fully dependent on fertiliser imports. With no mineral fertilisers present, a future green Kenyan fertiliser sector will still need to import other key nutrients.

Regional trade can be both a boon and a threat: it can provide regional market access and complementarity to achieve scale, such as in the case of Namibia, whose hydrogen and green ammonia developments target in the first place offtakers outside Africa, but a reported offtake agreement was signed for a smaller amount of 40,000 tons of green ammonia with a nitrogen fertiliser plant in Zimbabwe, which currently sources grey ammonia from South Africa. Regional trade can also create competition for a nascent hydrogen economy. Ethiopia is developing its hydrogen strategy, which certainly will leverage the country’s 100% renewable energy mix and reportedly has fertilisers as one of its priorities, which is similar to the approach by its neighbour Kenya.

Long-term perspectives and fierce competition

While existing (export) markets are driving investments in Morocco and Egypt, new producers of ammonia end-use products will need to bridge a far greater distance than existing ones in terms of capital investments, capacity development, and domestic and export markets. Combining an industrialisation agenda with agricultural strategies is one way to make that distance smaller, namely by supporting a domestic end-use market for hydrogen.

While there is great uncertainty about the size of the near-future markets for green hydrogen-derived products, worldwide demand for nitrogen fertilisers is projected to grow continuously in the near future. Growth potential for fertilisers is particularly high in sub-Saharan Africa, which uses almost seven times less per capita than the global average and more than ten times less than Europe.

Yields and fertiliser use go together. Limited input use means that African agricultural yields are among the lowest in the world, leading to severe sustainability and food security consequences. The African Union sought to increase fertiliser use between 2006-15 and support fertiliser production, but it fell way short of its target of 50 kg per hectare (Figure cropland). In 2021, only seven countries achieved this target.

To attain food self-sufficiency by 2050, however, Africa would need to increase its nitrogen fertiliser use to 181 kg/ha, more than five times the estimated use of 2016. Experiences from other regions indicate that Africa’s projected demographic and economic growth would lead to more fertiliser use.

Source: FAO

Can (growing) fertiliser markets help establish Africa’s green hydrogen sectors, and which country is likely to benefit? Pursuing more fertiliser use is the first challenge. Input subsidies can guarantee an offtake or price level. But spurring demand through policy brings you only so far: even though the main obstacle of low fertiliser use is expense, the benefits of subsidies are generally merely modest, and can lead to wasteful overapplication with negative environmental impacts. For input subsidies to effectively support fertiliser use, it should be part of a wider transformation of African agriculture rather than seen as a cure-all remedy.

Second, both current green hydrogen and fertiliser production are examples of industrial processes where electricity prices are king, but scale rules supreme. Many countries have some ammonia production capacity, but scale needs mean overall production is highly concentrated. Achieving viable scale means ensuring other domestic uses for green hydrogen and ammonia and connecting to regional and global export markets. With an expected increase in intra-Africa trade powered by the AfCFTA, there may be opportunities for more (green) African fertilisers to feed Africa. Yet this may, in the first place, benefit existing large-scale North African producers (Figure production).

The newcomer status of sub-Saharan African countries means they will need sufficiently large demand to absorb the high initial capital costs to set up green hydrogen and fertiliser facilities, as well as export chains. This requires an explicit hydrogen strategy integrating industrialisation, agriculture and investment strategies and exploits the synergies in between. Opting for a gradual approach, starting with small-scale projects and local off-take, may keep initial and sunk costs low. However, it risks missing out on the greater efficiencies and competitiveness achieved through large-scale production.

Conclusions

The hydrogen economy offers opportunities in African countries, some of which are well placed to produce some of the lowest-cost green hydrogen in the world. Yet the road to African hydrogen economies will be less clear-cut than a superficial reading leads to believe. The main challenge is not only the ability to produce hydrogen at the lowest cost, and feed into export markets; it is also whether African countries can develop their hydrogen sector competitively.

Early investments in production infrastructure, but also export off-takes and industrial use will likely be defined by subsidies and regulatory pressure (e.g. ETS) in the major industrial centres of Europe, the US and China. The global hydrogen and derivatives market is set to grow exponentially between now and 2050, yet some short- to medium-term demand projections may not be reliable. Some policy targets, including the one from the EU, rely on a maximalist scenario of hydrogen use, which may overestimate short-term demand for green hydrogen and derivatives. Technically, industrial consumption of hydrogen and ammonia would be most cost-effective close to where hydrogen production costs are lowest. Prioritising exports first and then domestic hydrogen markets may be a viable pathway for some, but it may entail significant risks for others further away from existing industrial clusters, as the commercial viability of long-distance hydrogen and ammonia trade will likely only be reached well after 2030.

Green ammonia for fertilisers stands out as an end-use as it can hit multiple birds with one stone: tapping into global export markets for green fertilisers, supplying potential domestic and regional growth markets, while also shielding producers from price volatility and foreign dependency on fossil fuel-derived ammonia.

Opportunities for green fertiliser industries, however, will also be unevenly divided. North African producers are moving to decarbonise existing production while setting up a hydrogen economy that can be fairly easily linked to Europe. With little fertiliser production and use, the starting point for Sub-Saharan Africa to produce green fertilisers is different. It requires significant upfront investments in hydrogen industries, as well as a systemic reform of agriculture. Regional trade through AfCFTA can be both a boon and a threat: it can provide regional market access and complementarity to achieve scale, but also competition for a nascent national hydrogen economy.

Opportunities exist, yet making this work will require action on multiple fronts:

- Developing politically and economically feasible hydrogen roadmaps and strategies built on realistic and updated demand projections for both exports and domestic consumption

- Developing African ‘no-regret’ hydrogen and power-to-x pathways, prioritising domestic sectors and use cases that can create long-term value locally. This may include a stronger emphasis on e-fuels and

- Strong industrial policies to project a viable pathway to hydrogen production and consumption, ideally across multiple industries and off-takers

- Regional frameworks and infrastructure pathways for regional cooperation and trade in hydrogen and derivatives to enable economies of scale and complementary investments

- In the case of fertilisers: decarbonise existing production in North Africa, and integrate industrialisation and investment strategies with a significant and systemic reform of agriculture in sub-Saharan Africa.

This guide is part of an ongoing research project into the political economy of green industrialisation in African countries. For more information, get in touch with Alfonso Medinilla (head of climate action and green transition at ECDPM)

Endnotes

- The EU hydrogen bank is a financing instrument to support hydrogen production in Europe and globally. It seeks to initiate production through auctions, offering a fixed premium per kg of hydrogen over 10 years. This is meant to provide security for first movers and create an affordable initial supply of hydrogen alongside other industry decarbonisation measures.

- Figures from August 2023.

- The US hydrogen tax credit will provide up to $ 3 per kg of production for zero emissions hydrogen, which is meant to make these initial investments price competitive with fossil-derived hydrogen.

- For hydrogen carriers, the costs of conversion and reconversion can add up.

- OCP reportedly spent $ 2 billion on ammonia in 2022, due to price spikes following the Russian invasion in Ukraine.

- While Kenya launched its first fertiliser mixing plant in 2021, this plant also solely relies on imports.

- 77kg would come from synthetic nitrogen, the rest from organic fertiliser.

- China produces 30% of world production.

This publication benefits from the structural support by ECDPM’s institutional partners: Austria, Belgium, Denmark, Estonia, Finland, Ireland, Luxembourg, The Netherlands and Sweden.