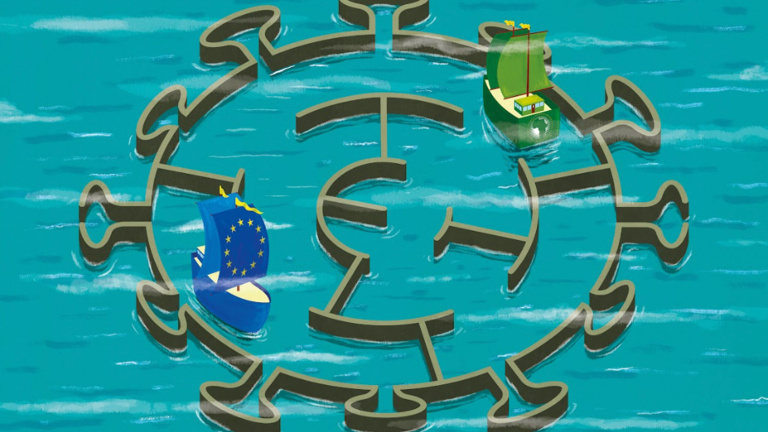

European Investment Bank tackles COVID-19 and climate change with its African partners

The COVID-19 pandemic puts increased strain on the already stretched public and private financing in Africa. The pressure could set back the continent’s sustainable development and economic growth by decades, unless there is a major response now.

Commitment to COVID-19 response in Africa

African finance ministers have called on European partners and the international community to support public health and economic resilience, emphasising the need to focus on Africa’s private sector.

In April, the European Investment Bank (EIB) promised support totalling €5.2 billion, as part of Team Europe’s response to the pandemic beyond Europe’s borders. Our commitment to the COVID-19 response in Africa targets both the immediate impacts of the disease and continuation of the long-term investment that is essential for climate action and sustainable development.

Since COVID-19 struck, EIB financial and technical experts in offices across Africa and at our Luxembourg headquarters have worked closely with hundreds of public and private sector partners to identify and respond to the new challenges thrown up by the pandemic. Coordination has also been a key feature of our action within Team Europe, in particular, with the European Commission and European public banks. Like other multilateral development banks, we joined the G20 Debt Service Suspension Initiative and committed to provide positive net flows to eligible countries. Here is what we have developed so far.

Scaling up support for public health

We are working with the World Health Organization to strengthen primary health care across Africa. This includes scaling up financing to protect medical supply chains, to improve hygiene and safeguard medical workers, and to reduce the spread of COVID-19, in partnership with the Global Vaccine Alliance, GAVI.

In Senegal, Niger and Malawi, in the countries around Lake Victoria, and elsewhere in Africa, we are working with UN-Habitat and European partners to help local authorities improve hygiene. This is an essential part of large-scale water projects, and is crucial in managing the pandemic.

In Morocco, we are helping transform medical care at 16 hospitals and improving the supply of medical equipment for public health efforts to slow the spread of COVID-19.

Strengthening economic resilience across Africa

The EIB has already launched fast-track regional financing initiatives to increase public health investment and support new private sector lending through hundreds of local financial institutions. New, targeted private sector financing is being rolled out across Africa, following agreement on the first national programme in Senegal and a pan-African programme with Afreximbank.

This financing will ensure that entrepreneurs, smallholders and businesses across Africa can continue to access finance, including local currency and working capital, even in the face of shuttered export markets, reduced demand and continued uncertainty.

These new programmes build on ongoing investment with experienced African financial institutions already delivering hundreds of small-scale clean energy, digital, education, health and micro-finance schemes across the continent.

Building on our track record of support for mobile banking, telecommunications and connectivity across Africa, the EIB and United Nations Development Programme (UNDP) have brought together policymakers and business leaders from across the continent to share experiences with proven digital solutions that can help combat COVID-19 and strengthen economic resilience.

Ensuring that global financial and technical expertise benefits Africa

In 2019, the EIB provided more than €1.8 billion to support private sector investment across Africa, representing 60% of its overall engagement on the continent. This included €500 million of new dedicated support for African start-up companies’ initiatives in digital, agribusiness, financial inclusion and health services.

Across Africa we ensure that technical, environmental, social and financial expertise and sector understanding is shared with project promoters, financial partners and the private sector.

Just before the COVID-19 pandemic, we completed training programmes for more than 4,000 African financial professionals in best banking practice, climate risk and sustainable finance skills. These will contribute to improve local financial markets and increase African banks’ contribution to long-term development.

In Uganda, the country that hosts the largest number of refugees in Africa, we partnered with the UN Refugee Agency to provide a two-week training programme for refugees and host communities to improve financial inclusion and financial literacy. By helping entrepreneurs expand business activity, the Ugandan programme will reduce unemployment in rural communities and improve access to loans for refugees and host communities.

Continuing climate and gender action in Africa

The EIB’s unique technical and financial expertise in supporting climate action and renewable energy is transforming access to clean energy, sustainable transport and reliable water supply across Africa. This helps protect vulnerable smallholders from droughts and floods.

Through high-impact financing, sharing technical best practice with local banks and blending our loans with EU grants, we help put public transport alternatives on the congested roads of Cairo, Rabat and Dakar. With the same tools we are providing clean water for the first time to millions of residents of Ouagadougou, Bamako and Niamey and enabling villagers in remote communities across Mozambique and Uganda to access solar power through off-grid technology. Work on the ground is well underway on all these projects.

We are working with ongoing projects to better protect coastal roads in the island nation of São Tomé and to secure clean water supply for 2.2 million people in Madagascar’s capital, following recent typhoons.

Last year, our SHEInvest initiative started unlocking €1 billion of new investment to boost gender equality and female economic empowerment. The aim is for millions of women entrepreneurs across Africa to have better access to finance – as well as to ensure that new climate, digital, water, energy and transport projects increase women’s economic participation.

Helping vulnerable communities, prioritising investment in fragile states

In recent years, we provided more than €2 billion in new financing to support high-impact investment in fragile states and least-developed countries in Africa.

Last year the EIB agreed to provide first-time telecommunications coverage for remote rural regions in West Africa and to ensure that rural regions of the Sahel can access microfinance.

We recently agreed to help pave the Mano River Union Road in Liberia. This will reduce seasonal closures after heavy rains and give more people access to markets and health care. It will also strengthen trade links between northern Liberia, Guinea and Côte d’Ivoire.

We are pioneering a new, innovative climate insurance scheme for smallholders, to strengthen the economic resilience of rural communities and local financial institutions in sub-Saharan Africa. Such insurance will help smallholders access finance to expand their activities and invest in new equipment, livestock and materials, as droughts and floods pose an ever-present risk.

Committed to supporting transformational investment in Africa

Africa is a key priority for the European Union (EU) and the EIB. Last year, the EIB provided €3 billion in new financing to support €10.7 billion in transformational investment across Africa. This builds on our 58 years of engagement across 52 African countries.

The EIB remains committed to working with African partners to respond to COVID-19 and to achieve the Sustainable Development Goals. As the EU Bank, we are also determined to be a key partner in implementing the ambitions of the next EU budget. We will continue to accelerate investment that delivers sustainable development, tackles the climate emergency, creates jobs and improves lives across Africa.

About the author

Ambroise Fayolle is Vice President of the European Investment Bank and member of the EIB Management Committee responsible for Africa, development and innovation.

Read the full magazine issue